The Trader’s Playbook

Most traders fail because they lack structure, not intelligence. These resources will show you how to trade with a plan, control risk, and use tools like TradingAgent AI to stay consistent.

This learning center covers the core principles every trader needs—from discipline and risk management to building a repeatable trading process. Start here to create clarity, confidence, and consistency in the markets.

-

January 30, 2026 2 min read

January 30, 2026 2 min read -

January 30, 2026 3 min read

January 30, 2026 3 min read -

February 1, 2026 2 min read

February 1, 2026 2 min read -

February 1, 2026 2 min read

February 1, 2026 2 min read

-

The One Habit That Separates Winning Traders From Everyone ElseJanuary 16, 2026 at 5:00 AM

Traders fail when emotions drive their decisions. Building consistent trading habits—reinforced with TradingAgent AI—turns impulses into disciplined actions, improving performance and long-term results.

-

How Emotional Trading Is Killing Your Profits (And What to Do About It)January 16, 2026 at 5:00 AM

Emotional trading destroys profits and confidence. TradingAgent AI provides structure and guidance to help traders make intentional, disciplined decisions, keeping emotions from driving losses.

-

Why Trading Success Has Nothing To Do With Where You StartJanuary 16, 2026 at 5:00 AM

This blog reinforces that trading success isn’t determined by financial background, starting capital, or confidence levels. Instead, consistency, discipline, and structure shape long-term results. It ties naturally into Blog #1 by focusing on behavior over background, with a soft mention of how TradingAgent AI helps traders stay structured.

-

Trading Is For Everyone (No Degree, No Background, No Barrier)January 13, 2026 at 5:00 AM

Trading isn’t reserved for a certain background or education — it’s a skill anyone can learn. Success comes from structure, discipline, and consistent decision-making. This blog encourages beginners and struggling traders while lightly highlighting how TradingAgent AI helps bring structure and clarity to the learning process.

-

Why You’re Overthinking Your Trades (And How to Stop)January 6, 2026 at 5:00 AM

Overthinking comes from too many decisions and not enough structure. By simplifying your setups, limiting your timeframes, marking levels early, keeping your rules simple, and using tools that eliminate guesswork, traders can make calm, confident decisions. TradingAgent AI supports this by providing clarity, structure, and daily guidance.

-

The Simple Routine That Makes Traders More ConsistentJanuary 6, 2026 at 5:00 AM

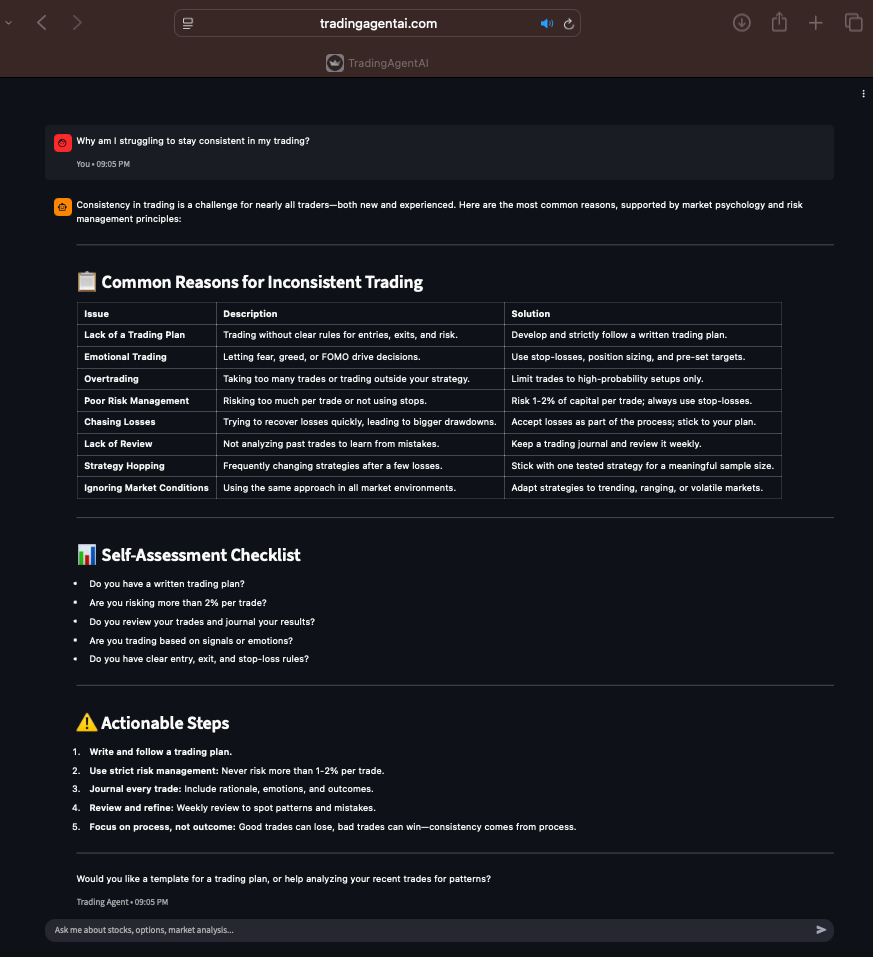

Consistency in trading doesn’t come from prediction — it comes from routine. A simple daily structure (pre-market prep, observing at open, waiting for quality setups, doing a mid-day reset, and reviewing at close) helps traders stay disciplined and calm. TradingAgent AI supports this process with daily guidance, analysis, and structured prompts.

Most traders don’t fail because they lack effort. They fail because they lack structure. TradingAgent AI helps you slow the chaos, ask better questions, and make smarter trading decisions with clear, repeatable guidance — whether you’re just getting started or trying to regain consistency.

-

Why Confidence in Trading Comes From Process, Not ProfitsDecember 28, 2025 at 5:00 AM

True trading confidence doesn’t come from profits — it comes from following a clear, repeatable process. When traders focus on preparation, rules, and risk management instead of daily P&L, confidence becomes stable and long-lasting, even through losses.

-

Why Trading Feels Harder Than It ShouldDecember 27, 2025 at 5:00 AM

Trading often feels harder than it should because traders are overwhelmed by noise, information, and constant decision-making without structure. When clarity is missing, emotions take over and every trade feels stressful. Simplifying the process, focusing on fewer decisions, and trading with intention helps reduce pressure and create consistency over time.

-

How TradingAgent AI Helps You Trade With Structure (Without Overthinking)December 27, 2025 at 5:00 AM

TradingAgent AI helps traders cut through market noise by providing structure, clarity, and guided decision-making. Instead of relying on more indicators or constant opinions, traders learn to slow down, ask better questions, and trade with intention before, during, and after each session. It’s built for newer and struggling traders who want consistency without overthinking.

-

The Difference Between Being Busy and Being Disciplined in TradingDecember 26, 2025 at 5:00 AM

Being busy in trading often means reacting without structure, while disciplined trading focuses on patience, rules, and selectivity. Discipline may feel boring, but it’s what leads to long-term consistency and growth.

-

Why Fewer Trades Lead to Better ResultsDecember 26, 2025 at 5:00 AM

Fewer trades often lead to better results because they improve focus, discipline, and decision-making. Overtrading creates emotional mistakes, while patience and selectivity build consistency over time.

-

What a Good Trading Day Actually Looks Like (Even When You Lose)December 25, 2025 at 5:00 AM

A good trading day isn’t defined by profit alone. It’s about preparation, discipline, risk management, and following your process — even on red days. Traders who focus on consistency and structure improve faster and stay in the game longer.

-

Why Structure Beats Talent in TradingDecember 25, 2025 at 5:00 AM

Most traders fail not because they lack talent, but because they lack structure. Clear rules, routines, and decision-making frameworks matter more than instincts or intelligence. Structure removes emotion, reduces mistakes, and creates consistency — especially for newer and struggling traders.

Trading doesn’t have to feel overwhelming. TradingAgent AI gives you a clear framework for navigating stocks and options by helping you prepare, execute, and review trades with intention. Whether you’re learning the ropes or rebuilding consistency, structure is what turns effort into progress.

-

The Questions Profitable Traders Ask Every DayDecember 24, 2025 at 5:00 AM

Profitable traders don’t chase trades — they evaluate them. By asking the right daily questions about market conditions, risk, alignment, and discipline, they stay consistent and protect their accounts. Better questions lead to better decisions, and better decisions lead to long-term profitability.

-

How to Use TradingAgent AI on a Real Trading Day (Step-by-Step)December 24, 2025 at 5:00 AM

This blog walks through how to use TradingAgent AI during a real trading day, from pre-market preparation to post-market review. It shows how traders use structured prompts, clear guidance, and decision support to reduce confusion, avoid emotional trading, and stay consistent—without relying on signals or guesswork.

-

Why Small Wins Matter More Than Big TradesDecember 23, 2025 at 5:00 AM

Big trades may feel exciting, but small wins are what build real trading skill and long-term consistency. This blog explains why focusing on disciplined, repeatable gains leads to better risk management, stronger confidence, and sustainable growth — and how TradingAgent AI helps traders stack small wins without emotional decision-making.

-

What to Do on Red Days (Without Blowing Your Account)December 23, 2025 at 5:00 AM

Red days are unavoidable in trading, but account blowups aren’t. This blog explains why traders struggle emotionally on down days, the common mistakes that lead to overtrading and losses, and practical steps to protect capital and mindset. Learn how focusing on process, reducing size, and using guidance from TradingAgent AI helps traders survive red days and stay consistent.

-

A Simple Daily Trading Routine That Actually WorksDecember 22, 2025 at 5:00 AM

A consistent daily trading routine helps traders reduce emotional decisions, avoid overtrading, and build long-term discipline. This blog breaks down a simple pre-market, trading, and post-market routine that actually works for stocks and options traders, and explains how guidance from TradingAgent AI supports better decision-making throughout the day.

-

Why Most Traders Quit Right Before They ImproveDecember 22, 2025 at 5:00 AM

Most traders quit trading not because they can’t learn, but because they reach the uncomfortable stage where progress feels slow and mistakes become more visible. This blog explains why that phase is actually a sign of improvement, how lack of structure causes traders to give up too early, and how TradingAgent AI helps stocks and options traders push through confusion and build real consistency.

-

Why Waiting Is a Trading Skill (And Why Most Traders Never Learn It)December 21, 2025 at 5:00 AM

Waiting isn’t a weakness in trading — it’s a skill. This blog explains why most traders overtrade, how patience protects your capital, and why selective timing matters more than constant action. Learn how waiting for the right setups leads to clearer decisions, fewer emotional trades, and more consistent results.

The market isn’t short on information — it’s short on clarity. TradingAgent AI helps you focus on what actually matters by guiding your thinking before, during, and after each trade. No hype. No guesswork. Just a smarter way to approach stocks and options with confidence and control.

-

Trading Information vs. Trading Guidance: Why Most Traders Confuse the TwoDecember 21, 2025 at 5:00 AM

Most traders stay stuck not because they lack information, but because they confuse information with guidance. This blog breaks down the key differences between the two, explains why consuming more trading content often leads to confusion and overtrading, and shows how structured guidance helps traders make clearer, more disciplined decisions. Learn why context matters, how guidance reduces emotional trading, and how TradingAgent AI helps stocks and options traders trade smarter with confidence.

-

Why Most Traders Stay Stuck (And How to Break the Cycle)December 19, 2025 at 5:00 AM

Most traders stay stuck not because they lack effort, but because they’re using the wrong tools. This blog explains how information overload, emotional trading, and a lack of structure keep traders from improving—and how better tools and AI-driven guidance can help break the cycle and build consistency with clarity and confidence.

-

📊 How to Start Day Trading: A Simple Step-by-Step GuideDecember 4, 2025 at 5:00 AM

This guide explains how to start day trading step-by-step, including market basics, technical analysis, choosing a trading market, opening a brokerage account, and creating a profitable trading plan. It highlights risk management strategies, paper trading practice, and how to begin live trading safely. Ideal for beginners searching for day trading tips, trading strategies, and how to start day trading with confidence.

-

📊📝 Beginner’s Guide to Stock Trading: How to Start and Succeed (Even If You’ve Never Traded Before!)October 22, 2025 at 4:00 AM

🚀 Why Trading Can Be for Everyone

Are you curious about the stock market but feel overwhelmed by charts, jargon, and fast-moving prices? Maybe you’ve tried trading before but ended up frustrated or confused. You’re not alone! Many people start with big dreams but little guidance. The good news: anyone can learn to trade successfully with the right mindset and tools.

-

Harnessing AI for smart tradingAugust 15, 2025 at 12:11 PMIn today's rapidly evolving financial landscape, unlocking the potential of AI technology in trading strategies is not just an option—it's a necessity for those looking to stay ahead of the curve. Advanced AI tools are transforming decision-making processes by providing traders with real-time insights and data-driven recommendations, enabling them to make informed choices with confidence. As we delve into the exciting future of smart trading, we'll explore how AI innovation is revolutionizing the way traders approach the market, empowering both novice and seasoned investors to navigate complexities with unparalleled precision and efficiency.

-

Retail traders leading the wayAugust 22, 2025 at 4:00 AMIn recent years, the investment landscape has experienced a seismic shift with the rise of retail traders, who are increasingly stepping into the spotlight as they seek to maximize their investment potential. Technology has played a pivotal role in this democratization of trading, offering sophisticated tools and platforms that empower everyday investors to make informed decisions—often with the speed and precision once reserved for institutional traders. Coupled with a vibrant community and a wealth of educational resources readily available online, retail traders are not only gaining confidence but also fostering a collaborative environment where knowledge-sharing leads to smarter trading strategies and a more informed approach to the markets.

-

Maximize your trading potential with AI insightsAugust 23, 2025 at 3:22 AM

Unlock the transformative benefits of AI-driven analytics to elevate your trading success and decision-making strategies. By harnessing the power of AI insights, traders can gain a competitive edge, transforming raw data into actionable strategies that enhance performance. This blog post explores how AI can refine your trading approach, offering practical tips on leveraging cutting-edge technologies to maximize your trading potential and navigate the markets with confidence. Whether you’re a seasoned investor or just starting, discover how TradingAgentAI can empower you to make smarter, data-driven decisions that drive results.